Pay Tax Rates

You can create a Set Pay Tax Rates by following these steps.

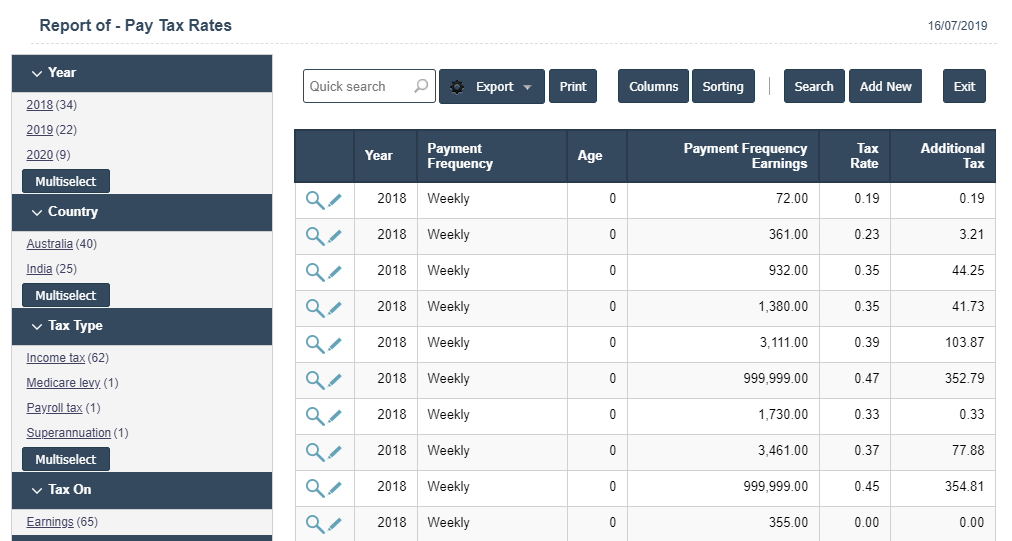

1. Pay Tax Rates: Pay Tax Rate is the Percentage of income a person or company pays in taxes.

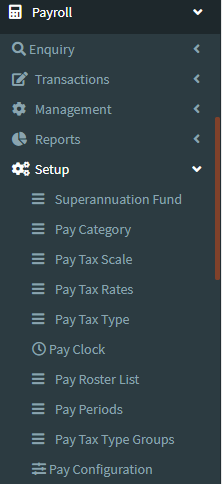

2. To add for Pay Tax Rates can be added and updated by clicking on the Payroll and then selecting Payroll setup after then click on the Pay Tax Rates.

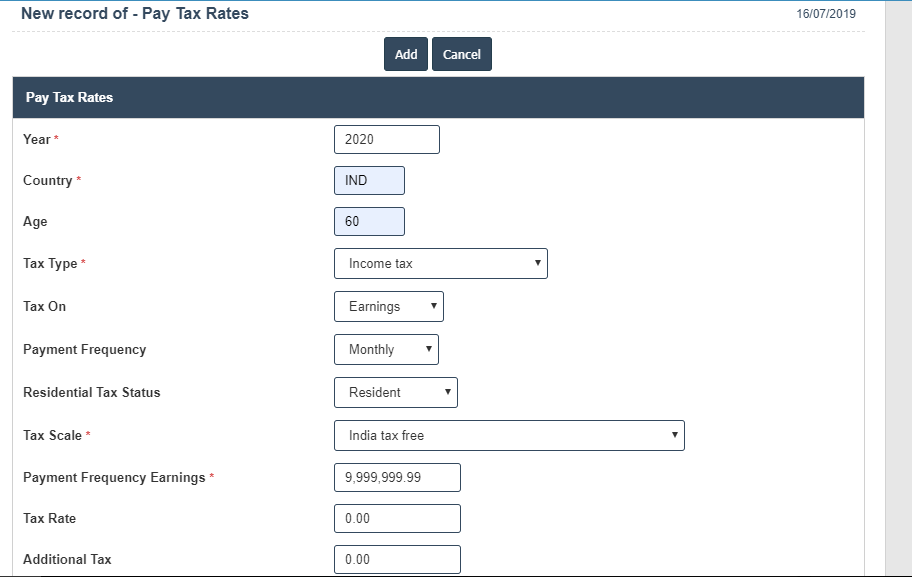

3. To add a new Pay Tax Rates click on the Add New button as shown below.

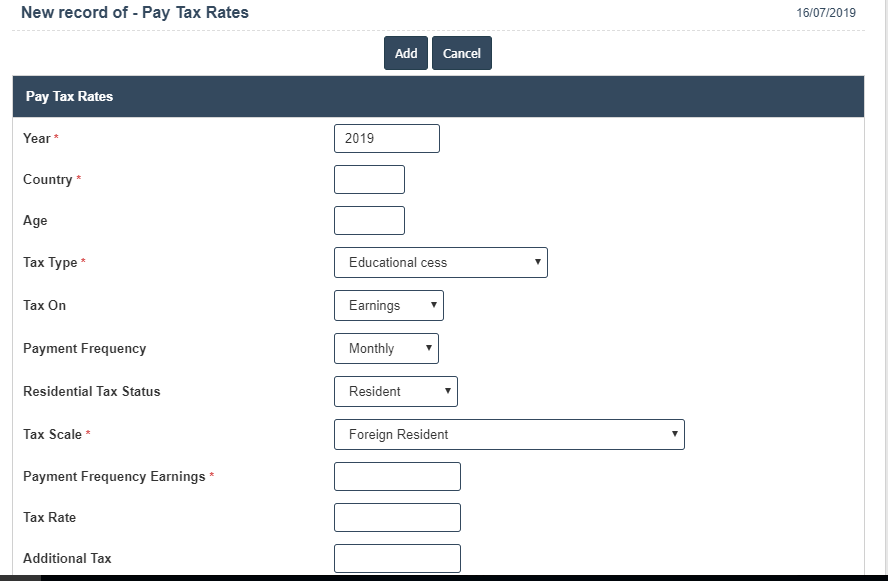

4. New Pay Tax Rates will open the new page and enter the manually all the details.

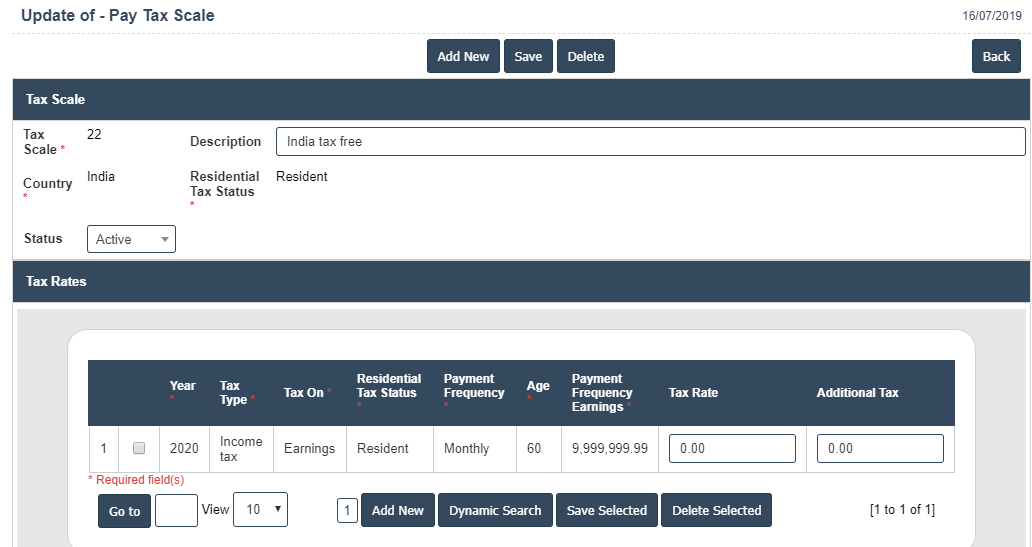

5. Fields in this Pay Tax Rates include:

- Year

- Payment Frequency- Weekly, Monthly and Yearly.

- Age

- Tax Type- Education less, Income Tax and Superannuation

- Payment Frequency Earnings

- Tax Rate

- Additional Tax

- Residential Tax Status- Resident and Non-Resident

- Tax on- Earnings, Allowances, Deductions and Taxes.

- Tax scale- Local Resident, India tax free and Foreign Resident

6. Once you have completed the Pay Tax Rates details, clicking the Add button as shown below.